Stay strong as a business and lead in your market amid the COVID-19 pandemic? Yes, you can! Learn more about managing your practice through an unprecedented time in this post addressing five common questions from our Audigy membership.

Q: What financial aspects should I be analyzing?

A: Look at the practice’s cash flow, and then determine how to gain access to cash in the event the practice warrants it.

Determine cash flow using a 3-step process:

1. Sources-and-Uses Analysis

- Determine how much cash is available and how much collectible accounts receivable is owed to the practice.

- Establish where cash is being spent — for example, payroll, rent, equipment.

- Assess how long your cash on hand can cover expenses and whether capital is available in the event of a shortfall.

2. Cash-Flow Management

- Determine the expected revenue generated over the next 3 to 6 months.

- Assess alternative ways to generate revenue.

- Determine whether there is a need for outside financing to cover expenses.

3. Revenue-Recovery Plan

- Determine gap revenue — difference in historical revenue by month in the prior year compared to COVID-19 revenue for the same months this year.

- Determine opportunities to close the gap revenue, such as extended schedule, weekend hours.

- Share this information with employees to set expectations and develop your business strategy.

- Determine your communication strategy to patients.

Other Financial Considerations

Personal Resources

- Assistance from family and friends

- Availability of personal or residential line of credit

- 401k withdrawal

- 10% early withdrawal penalty waived on aggregate distributions of up to $100,000 on workplace retirement plans and individual retirement accounts for COVID-19-related expenses

- Can elect to pay federal income tax on the distribution over 3 years or repay the distribution within a 3-year period to an eligible retirement plan

- Check with your state for cash-related stimulus programs that might be available

Professional Resources

- Availability of short-term payment deferment, if business funded through a manufacturer loan

- Availability of business line of credit

- Small Business Administration loan, which may provide up to $10,000 in emergency loan funding within 3 days of loan origination

- Leveraging of your relationship with the bank

Expense Reductions

- Delay manufacturer loan payments

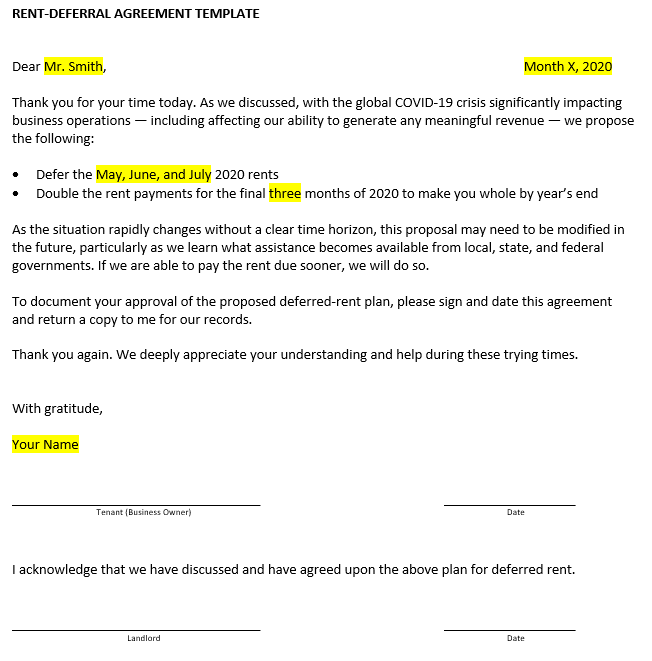

- Attempt to push out mortgage and rent payments — download our sample deferment-request letter

- Examine fixed and variable expenses

Q: What considerations should I give to staffing?

A: Staffing considerations depend on whether your practice is operational.

If operational — for example, servicing patients or able to engage in meaningful business activities without patient flow — with reduced hours for staff members:

Work Share Program — 28 states have a program in place; programs vary by state

- General Considerations

- Employers must apply and qualify

- Program is available when 10% of workforce is affected or it affects 3 workers within a business

- Maximum 45% reduction in employees’ workload

- Application to Practices

- Best suited for hourly employees that perform similar duties

- Under this program, 2 full-time employees would split full-time duties — each working at least 20 hours weekly, and the Work Share program would provide supplemental wages

Unemployment Insurance

- General Considerations

- Available in most states that don’t offer Work Share program

- Employees must apply and qualify

- Employee claims impact the practice’s revenue; employers are financially responsible for unemployment benefits

If not operational — for example, following state-mandated closure, lack of work performed remotely, or lack of capital to remain open — with no hours available for staff members:

Decision whether to lay off or furlough employees should follow assessment of government relief programs

Coronavirus Aid, Relief, and Economic Security (CARES) Act

- Emergency loans for small business — fewer than 500 employees — available for fixed costs such as salaries, medical benefits, rent or mortgage, utilities, and interest on existing debt

- Emergency loan monies cannot be used to expand or increase the business

- Possibility that the emergency loan could be forgiven if business maintains its current level of employees and their salaries

- If employees are laid off or if salaries are reduced, borrower may have to repay loan rather than receive potential loan forgiveness

Families First Coronavirus Response Act (FFCRA)

- For full-time employees, this benefit of 80 hours provides either:

- 100% of salary — capped at $5,110 for the 80-hour period

- 66% of salary — capped at $2,000 for the 80-hour period

- Options depend on rationale for absence from work, with reasons permitted including:

- Being diagnosed with COVID-19 or showing substantial symptoms requiring homebound stay

- Being placed in mandatory or self-quarantine isolation

- Having to care for others affected by COVID-19, including childcare when schools are closed

- In the event the employee can work from home remotely, the act does not provide benefits

Understanding Layoff vs. Furlough

- Layoff

- Separation of employment

- Employee no longer on the payroll, thus ineligible for company-sponsored benefits and should investigate COBRA coverage

- Could impact employer’s unemployment insurance costs

- Many states allowing temporary “standby” option, where employee doesn’t have to seek other employment and must be ready and willing to return to practice when recalled

- Furlough

- Temporary suspension of work and pay

- Employee might be eligible to retain company-sponsored benefits, at company’s expense

- In some states, employees might be eligible for unemployment insurance benefits

Q: How can I optimize my schedule?

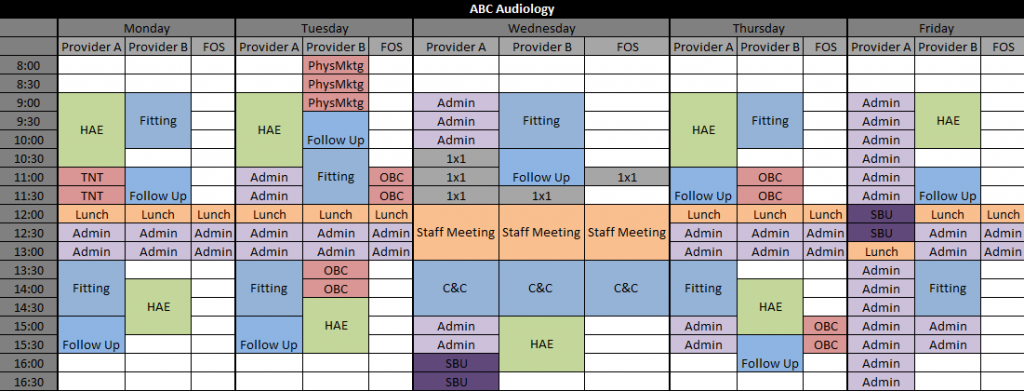

A: Block scheduling — whether in a hearing care practice or an ENT Clinic can offer substantial benefits:

- Provides time to maintain preventive safety measures — for example, infection control

- Allows you to prioritize revenue-generating appointments

- Improves productivity and efficiency by scheduling similar appointment types during a period in a given day

- Helps put you in control of time needed to attend to patients, staff, and administrative duties

Q: How should I communicate with my patients?

A: Be proactive — communication with your patients is crucial to (1) your overall commitment to patient care and (2) practice differentiation within the marketplace.

- For commitment to patient care:

- Follow up with patients who are still under a trial period.

- Reschedule those with existing appointments and provide modified services, as needed.

- Ensure your website provides updated working hours and modified services.

- For practice differentiation in the marketplace:

- Highlight your service offerings through various electronic platforms such as blogs, social media posts, and how-to guides.

- Internet usage has spiked with more Americans mandated to stay at home, making it all the more important to refresh your digital-marketing strategies in light of the pandemic.

- Update your website content to include topics searched by potential patients — “hearing loss” and “hearing aids,” for example.

- Consider marketing your services, supplies, and educational content to your patient database and community through digital means as well as approaches such as newspaper, radio, and television spots — depending on your market.

Q: What can I do to maximize my current downtime

A: Given the disruption in patient flow and operations, now is a good time to complete those projects that have been put off. To help make that happen:

- Download Audigy’s Healthy Practice Checklist — available for both audiology and ENT practices — to reestablish your business philosophy, given the recent changes in how health care will be practiced.

- Perform data governance, ensuring you have high-quality records by cleaning up your database — including removing patients no longer being serviced; removing unused appointment types, such as body aid fittings; and checking up on referral sources. Cleaning up the data also prepares the practice for marketing automation an effective relationship-building strategy designed to reach and engage patients at every point in their life cycles through specific, targeted, and personalized communication.